As I grow older and my life becomes dominated with family, work, and other important commitments, passive index investing becomes more appealing. As documented regarding my two ETF experiment to index my son's registered education savings plan, I love the simplicity of quickly rebalancing the portfolio once a year. I don't track the ETFs at all and no monitoring is undertaken. The hard work to identify attractively priced stocks, accumulate a position over time, while monitoring company news for red flags is completely eliminated.

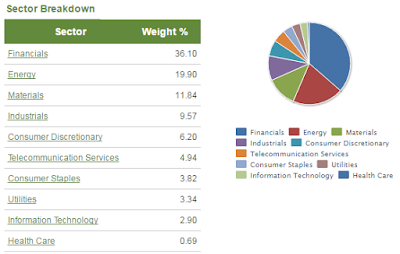

However, when I start to dig deeper into the composition of various Canadian indices that are featured in ETFs, the sector concentration is shocking. Even if you look at the broadest index in Canada, the S&P/TSX Composite Index, which covers approximately 95% of the Canadian equity markets, the combined exposure to financials (36.1%) and energy (19.9%) means 56% of your investment is concentrated in only two sectors. Key sectors for long-term growth such as information technology (2.9%) and health care (0.7%) are an insignificant portion of the index. With the top 10 holdings of the market capitalization weighted index accounting for 38.7% of the portfolio, returns are heavily reliant on financials (five of the top ten) and energy (three of the top ten). With 248 constituent companies, the market capitalization weighted index is heavily tilted toward the large financials, energy, and materials companies that dominate the Canadian landscape.

(Source: web.tmxmoney.com)

If the thought of including 248 companies is overwhelming, and you'd prefer to stick with the top 60 companies in Canada, maybe the S&P/TSX 60 Index would be a better fit. Although not as broad as the S&P/TSX Composite Index, the S&P/TSX 60 Index represents leading companies in leading industries. Its composition is also based on market capitalization, leading to even higher sector concentration in financials (38.4%) and energy (20.5%). The top 10 holdings represent 50.8% of the total index, reflecting high concentration in financials (five of top ten) and energy (three of top ten). Interesting long-term growth sectors such as technology (2.4%) and health care (0.4%) are basically a rounding error in the S&P/TSX 60 Index.

(Source: web.tmxmoney.com)

As a investor with a strong preference for dividends, I also decided to examine the S&P/TSX Canadian Dividend Aristocrats Index. In order to be considered for this index, the company must have increased ordinary cash dividends every year for at least five consecutive years. Interestingly, instead of being weighted based on market capitalization, this index is weighted based on indicated annual divided yield. This means companies which higher dividend yields (i.e. Corus Entertainment, Northview REIT, Granite REIT, etc.) compose a higher percentage of the index. Despite this difference in weightings, financials (34.0%) and energy (18.3%) continue to account for over half of the index value. Information technology represents an insignificant 1.7% of the index, and there is no health care exposure. The top 10 holdings account for 22.1% of the index, reflecting the different weighting criterion.

(Source: web.tmxmoney.com)

The Canadian indices covered above clearly contain a great deal of exposure to the financial and energy sectors. One might go as far as to say that passive index investors in Canada are making very big bets for and against particular industrial sectors. Despite the simplicity and convenience that passive investing offers, I'll stick to dividend growth investing that allows me more control over the companies and sectors I'm investing in, even if it requires more work. Lastly, although I'm always a little hesitant when sharing the diversification of my portfolio by industry sector (see here for YE16), the above analysis makes me feel slightly better about my own sector diversification.

How does your sector diversification compare to that of the leading Canadian indices???

I don't worry about sector concentration. I have 22% currently in the major utilities (FTS, EMA, CU, a bit of ALA); 19% in telecoms (the big three); 16% in pipelines (ENB, TRP) and 21% in the banks (BNS, TD, RY) + Alaris (thank you for highlighting this stock.) The rest is in food (Empire) and pharmacy outlets (Coutu).You can see I stick to the proverbial widows and orphans stocks: no surprises here.

ReplyDeleteWidows and orphans indeed. Surprised there's no railroad in your portfolio. Looks well diversified and uncomplicated. Congrats!

DeleteI'm sure you know Chowder (of the Chowder Rule.) I always liked what he said, "My idea of a Legacy Portfolio is where someone with no investing knowledge, one who doesn't wish to take the time to learn, one who simply wants to go on with their life without worrying about the markets can look at the portfolio and feel confident." I've tried to arrange things so that if anything happens, my wife will get a steady income from dividends and won't have to buy or sell anything, just collect the dividends and enjoy life.

ReplyDeleteCommenting on behalf of my father: Really enjoyed reading your post. It turned out to be really informational and so I'll be sure to follow your future posts too. Keep up the great work.

ReplyDeleteSuch frameworks pursue the standards carefully so as to expand your increase over the long haul. Also, it is for all intents and purposes demonstrated to give you progressively stable return. Australian trading account

ReplyDeleteThere is a belief that concentration isn't as much about paying attention to one thing, as it is about choosing to ignore everything else. It is more about the ability to give your undivided attention to a particular thing.If you want your child to make it to the top - teach how to go the extra mile

ReplyDeleteFinTech Weekly is a news solution that maintains you approximately date with one of the most important devlopments in business. We do not concentrate on the most up to date product launches yet try to catch the existing patterns as well as tendencies in the financial organisation. Our newsletter covers specialist understandings as well as high-quality short articles taking a look at the sector's condition and forecasting development in the marketplace. Take a look at our variety of services consisting of the latest news. Bruc Bond endeavor to lead the financial sector with sustainability, customizable product offering, and open communication. At Bruc Bond we aim to make 21st century banking straightforward, simple, and transparent.

ReplyDelete