Since the second quarter of 2017 was pretty hectic for me on the investment front with nine transactions, my Q3 watch list is more limited in scope. With shares of 35 companies in my portfolio, an all time high, it would take a high quality company at a great value in order to add a new name to my list of investment holdings. Since my portfolio consists of my unregistered account, my TFSA, and RRSP, that will be the format in which I present my considerations.

Unregistered Account

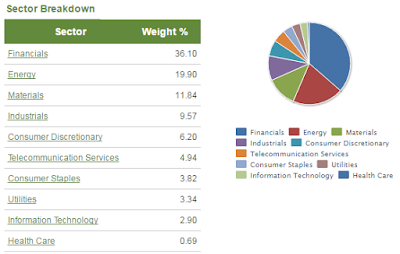

After initiating a position in Aecon Group (TSE: ARE) in May, it was with mixed feelings that I saw the stock climb over 8% in the last month. The rise is share price put a temporary delay on my plans to slowly add to my position. My attention shifted more toward Enbridge (TSE: ENB) and Enbridge Income Fund (TSE: ENF) as their prices have fallen along with oil prices. My main issue is that I currently own full positions in each of these related companies, and have to consider if going overweight makes sense from a diversification perspective. In terms of other companies that are on my radar, First National (TSE: FN), CIBC (TSE: CM), and Suncor (TSE: SU) are all interesting. First National and CIBC are both attractively valued, but don't help my portfolio diversification aspirations. Although Suncor would help from a diversification perspective, it's difficult for me to justify paying more than 40 earnings for such a cyclical company. If there was a dark horse that provides me diversification (into the insurance sector) and a fair value (P/E ~ 11X), it would Power Financial (TSE: PWF) which I have owned before, but is not a consistent dividend grower. Lastly, I have also considered re-initiating a position in Inter Pipeline Ltd (TSE: IPL) and then selling my Kinger Morgan position in my RRSP in order to avoid overexposure to pipelines.

TFSA

With very little cash left in my TFSA, I don't foresee any transactions unless they are short-term trades to increase my position in Brookfield Infrastructure Partners L.P. (TSE: BIP.UN). Brookfield management's record of dividend growth is outstanding, as is there record of accreditive acquisitions.

RRSP

Having decided to take a break from paying my discount brokerage $30 per quarter for a fair CAD/USD exchange rate, my plan for the third quarter is to use my cash and dividends to top-up my position in A&W Revenue Royalties Income Fund (TSE: AW.UN). With a yield over 4.5%, and a P/E in the 20X range partely due to underwhelming first quarter results, I'm fine with adding to this position due to A&W's strategy of more urban locations throughout Canada. The only US stock I would consider changing my plan for is Tanger Outlets (NYSE: SKT), as I find the long-term risk/reward equation favorable despite a slight recent run-up in share price.

Since it's almost the middle of the year, it seems like an appropriate time to check-in on my simplified 2017 goal:

Increase forward dividend income by $2600 while achieving a dollar-weighted average organic dividend growth rate of at least 5%.

I'm very happy to report that my forward dividend income is up by over $1000, while my dollar-weighted average organic dividend growth rate is currently 3.47%. If the forward income appears behind schedule, it's mainly due to growing my cash position in my unregistered account by about 125%. This reflects the difficulty I am having finding quality Canadian companies to invest in at fair prices. In contrast, if the 3.47% appears I am ahead of schedule, it is misleading as most of my holdings increase their dividends in the first half of the year. Although I think the 5% target remains achievable, it will require me putting capital to work in companies who raised their dividend by more than 5% while continuing to avoid dividend cuts.

Which companies appear at the top of your watch list for Q317 and how are you progressing toward your financial goals?